Table of Contents

Mortgage Rates Roller Coaster: Up, Up, and Away

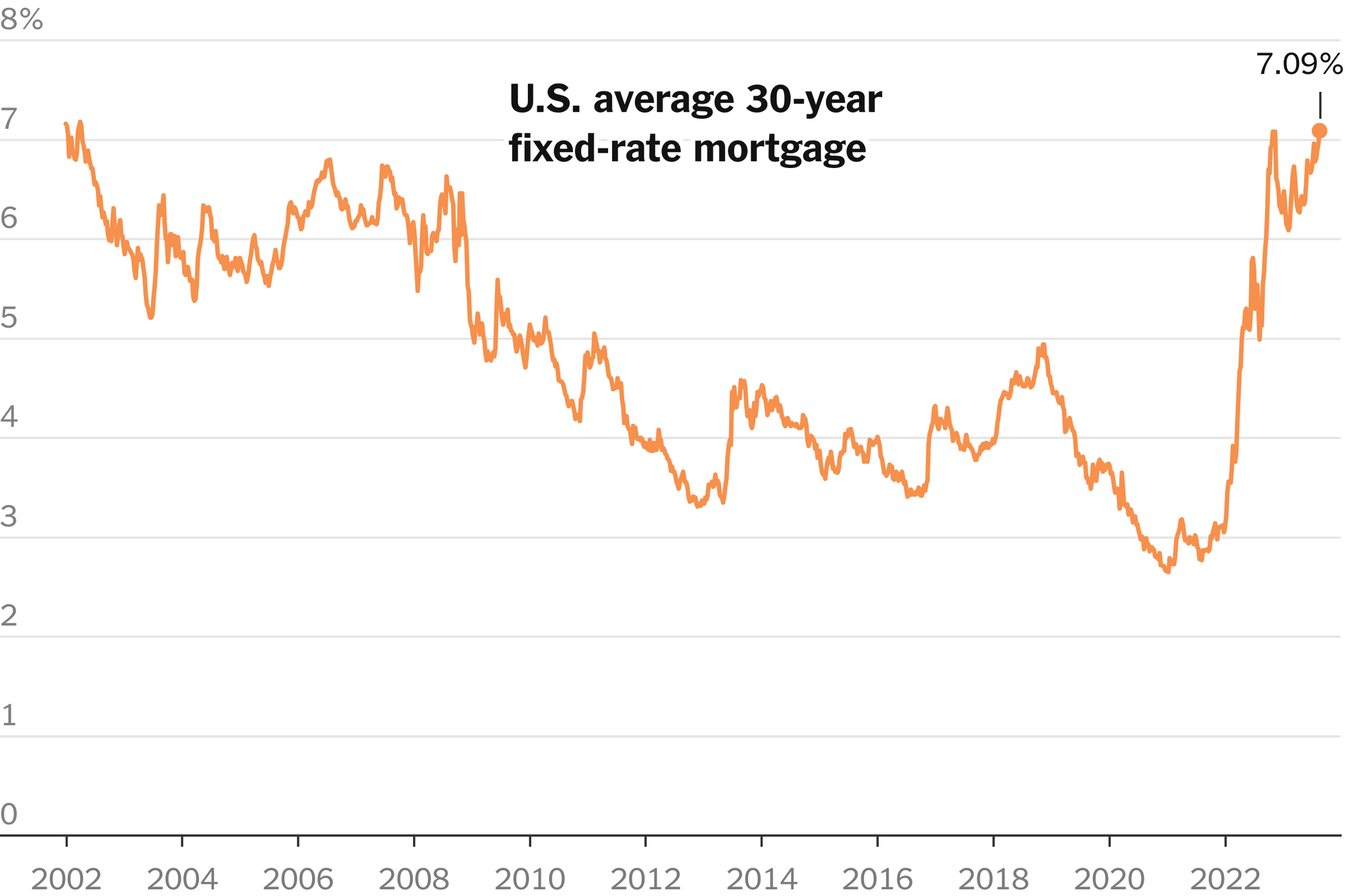

Buckle up, folks, because the world of U.S. mortgage rates just took a wild twist. Hold on to your hats as the average 30-year fixed-rate mortgage, that superstar of home loans, has surged past the 7 percent mark, leaving last week’s 6.96 percent in the dust.

Unveiling the Shocking Numbers

In a recent revelation, Freddie Mac, the mortgage authority, dropped the bombshell: the 30-year fixed-rate mortgage is now soaring at a jaw-dropping 7.09 percent. If we take a time-travel back a year, it was enjoying the calm waters of 5.13 percent.

Strap In for the Long Haul: What Experts Say

Seasoned market experts are predicting this roller coaster might just stick around for a while. Brace yourself for a gradual dip as time goes on. But make no mistake, this 7.09 percent rate is a record high since April 2002 – quite a shift from the days of rates swooping below 3 percent during the early pandemic frenzy.

The Rate Surge’s Sneaky Partner: The Federal Reserve

The sudden surge in rates is tied to the Federal Reserve’s mission to tame surging inflation by upping interest rates. The catch? This punchy move has left the housing market a bit dazed and confused. Homeowners, used to snugly low U.S. mortgage rates, are hesitating to put their beloved homes up for sale, making the already-thin market even sparser.

Hitting Home: Real Consequences

June’s stats are painting a gloomy picture: existing home sales have tumbled by nearly 19 percent compared to last year, as per the National Association of Realtors. This scarcity of available homes has had a ripple effect on prices. Imagine, the average price of an existing home now hovers around $410,200 in June – second only to the sky-high $413,800 recorded a year back.

Forecasting the Storm: What the Experts Predict

The crystal ball of real estate experts doesn’t exactly show a rainbow either. A big-name financial player, Goldman Sachs, recently raised some eyebrows with its predictions – brace for a 1.8 percent price hike this year and a whopping 3.5 percent spike in 2024. The culprits? A tight housing supply and a seemingly insatiable demand for houses.

Dreams Deferred: A Personal Story

Kathleen Schmidt’s story is a testament to the real-life consequences of this surge. Based in New Jersey, she’s been dreaming of a cozy townhome, diligently saving up a 20 percent down payment. But the sudden rocketing of mortgage rates has cast a shadow on her dreams. “We are never going to be able to buy a home,” she sighed, echoing the sentiments of many.

Affordability Tango: Navigating the Challenge

Affordability, as Jeff Ostrowski, a finance expert, puts it, is playing a disappearing act. He’s encouraging buyers to roll up their sleeves and get creative in the face of this challenge.

Bright Spots Amidst the Gloom: New Construction

But hey, every cloud has a silver lining! As existing homes become as rare as unicorns, the interest in new construction is reaching new heights. In June, sales of new homes soared by almost 24 percent compared to the previous year. And the construction of new homes caught some tailwind, marking a 6 percent jump in July compared to the year before.

Federal Reserve’s Shuffle: Impact on the Scene

Amidst all the chaos, the Federal Reserve is playing its cards, hiking up interest rates to rein in an overheated economy and temper inflation. The outcome? The highest interest rates in a whopping 22 years. Though inflation has cooled down compared to last year, recent gas price hikes are stirring the pot again.

Crystal Ball Gazing: How Long Will This Last?

The burning question remains: how long will these towering mortgage rates stay as the new norm? Lawrence Yun, an expert in the field, hints at a potential silver lining, suggesting a slow easing of rates by next spring or even before the year wraps up. But before you start celebrating, remember that even though the Federal Reserve aims to bring rates down by 2024, it might be a while before they waltz back to pre-pandemic levels.

Rates and Reality: A Delicate Dance (U.S. mortgage rates)

Think of U.S. mortgage rates like a seesaw tied to a bundle of 10-year Treasury bonds. These rates sway and swing with inflation predictions, the Federal Reserve’s moves, and how investors read the play. And in a rather unexpected twist, the 10-year yield shot above 4.3 percent – something it hadn’t done since 2007.

The Housing Maze: Navigating the Challenge (U.S. mortgage rates)

In this housing puzzle, one thing is clear: the market is showing its wild side. It’s a challenging maze for everyone involved, from hopeful homeowners to the bigwigs calling the shots. So, whether you’re dreaming of a cozy abode or keeping a keen eye on the market, hold tight – it’s bound to be an exciting ride.

U.S. mortgage rates

College Credit cards: What college students should know about getting their first credit card