How to choose the best education loan?

How To Lower Student Loan Interest Rates?

Education loan for abroad studies

In today’s time, education has become very expensive, many promising students leave their education midway due to lack of money or take loans from banks for further education. Completing your education by taking education loan from banks can be a better option.

Today in this article we will discuss this topic in detail.

There are many types of education loans, some education loans are available for studies in India only, while some student loans are also given for studies abroad.

In India, these education loans are provided by public and private sector banks. Although student loans are expensive, the interest rates offered by public and private sector banks are lower than those offered by non-banking financial companies.

Here are some of the best student loans according to a survey by Forbes Advisor, here you will learn in detail about some of the best student loans out of all the student loans available in the market, which student loan is the best, whose interest What are the lowest rates and eligibility for student loans.

Best student loans

- State Bank of India:

- Punjab National Bank:

- Bank of Baroda:

- ICICI Bank:

- Bank of India:

- Bank of Maharashtra:

- Central Bank of India:

Let us now talk about these loans in details.

1. State Bank Of India Check Today Rate – Click Here

SBI is the largest public sector bank of India. It provides various types of loans to Indian students so that they can complete their studies. Student loans given by SBI are available to the students studying in India and abroad. This bank Also provides skill based loans.

SBI provides 100% loan at low interest rate to students who have already got admission in premier institutions. Let us know the student loans given by SBI and their interest rates.

| Aspect | Details |

|---|---|

| Processing Fee | – When you’re borrowing for studying abroad, there’s a processing fee, which can be as high as INR 10,000 – If your loan exceeds INR 20 lakh, you’ll also face similar charges. – However, if you’re a scholar, upskilling, or transferring an existing education loan from another bank, you won’t have to worry about this fee. |

| Security | – Loans above INR 7.5 lakh will require tangible collateral security. It acts as a safety net for the bank in case of repayment issues. |

| Co-borrower | – Your co-borrower, the person sharing financial responsibility, is typically your parents or guardians. |

| Margin | – For studies in India with a loan amount over INR 4 lakh, you’ll need to contribute 5% of the total cost as margin. – If you’re studying abroad, the margin requirement is higher at 15%. |

| Collateral | – Collateral is applicable when taking over an existing education loan from another bank. |

| Concession | – Female applicants can enjoy a concession of up to 0.50% on the Rate of Interest (RoI). It’s a benefit tailored to make loan terms more favorable for women. |

* SBI STUDENT LOAN SCHEME

| SBI STUDENT LOAN SCHEME | ||||

|---|---|---|---|---|

| Loan Limit | EBR | CRP | Effective Interest Rate | Rate Type |

| Upto Rs 7.5 Lakhs | 9.15% | 2.00% | 11.15% | Floating |

| Concession | 0.50% concession in interest for girl students | |||

| Above Rs 7.5 Lacs | 9.15% | 2.00% | 11.15% | Floating |

* SBI SKILL LOAN SCHEME

| SBI SKILL LOAN SCHEME | ||||

|---|---|---|---|---|

| Loan Limit | EBR | CRP | Effective Interest Rate | Rate Type |

| Upto Rs 1.5 Lacs | 9.15% | 1.50% | 10.65% | Floating |

| Concession | No Further Concession | |||

* SBI GLOBAL ED-VANTAGE SCHEME

| SBI GLOBAL ED-VANTAGE SCHEME | ||||

|---|---|---|---|---|

| Loan Limit | EBR | CRP | Effective Interest Rate | Rate Type |

| Above Rs. 7.50 lacs & Upto Rs 1.5 Cr | 9.15% | 2.00% | 11.15% | Floating |

| Concession | 0.50% concession for students availing of SBI Rinn Raksha or any other existing life policy assigned in favour of our Bank | |||

| Further Concession | 0.50% concession for girl students | |||

* SHAURYA EDUCATION LOAN

(For wards of Defence & Indian Coast Guard )

| SHAURYA EDUCATION LOAN (For wards of Defence & Indian Coast Guard ) | ||||

|---|---|---|---|---|

| Loan Limit | EBR | CRP | Effective Interest Rate | Rate Type |

| Upto 7.50 lakhs | 9.15% | 2.00% | 11.15% | Floating |

| Concession | 0.50% concession for girl students | |||

| Above Rs. 7.50 Lakhs & Upto Rs. 1.50 Cr | ||||

| In case of Secured Loan | 9.15% | 2.00% | 11.15% | Floating |

| In case of Unsecured Loan | 9.15% | 2.60% | 11.75% | Floating |

* Advantages (pros) and Limitations (cons) of the SBI loan program

| Pros | Cons |

|---|---|

| – Low interest rates | – Not available for international students. |

| – Women applicants get 0.50% lower rates | – Limited availability for international students. |

| – Up to two years deferment of EMI extension allowed for students to complete the course. | – Limited flexibility for international students. |

2. Punjab National Bank Check Today Rate – Click Here

Punjab National Bank is a leading bank in India that provides education loan. This bank provides education to students studying in both domestic and international colleges. This bank provides education to the best students of Indian origin as well as such students.

Provides education which is related to OCI like those born abroad but pursuing higher education in India Punjab National Bank also provides student loan of Rs 50 lac to meritorious disabled students studying in colleges in India and abroad. Let us know its interest rate and other information .

| Extra Details | Details |

|---|---|

| Processing Fee | – Up to 1% for studies in foreign institutions. |

| Security | – Guarantors must pledge tangible collateral security for loans applied for abroad studies. |

| Co-borrower | – Typically, parents or guardians serve as co-borrowers. |

| Margin | – For studies in India with a loan amount above INR 4 lakh, a margin of 5% is required. – For abroad studies, the margin can range from 15% to 20%. |

| Concession | – Female applicants can enjoy a concession of up to 0.50% on the Rate of Interest (RoI). – Concessions are also available for students with disabilities. |

Punjab National Bank Student Loan

| Loan Scheme | Purpose | Interest Rate (%) Range |

|---|---|---|

| PNB Saraswati | Financial support for meritorious students pursuing higher education in India. | 11.25% to 12% |

| PNB Pratibha | Education Loan Scheme for premier institutes. | 8.55% to 10.50% |

| PNB Udaan | Education loan scheme for students pursuing higher education abroad. | 10.75% to 11.50% |

| PNB Kaushal | Education Loan Scheme for pursuing vocational education and training. | 10.25% to 10.75% |

| PNB Pravasi Shiksha Loan | Education Loan Scheme for overseas citizens in India (OCI), Persons of Indian Origin (PIO), and students born abroad pursuing higher education in India. | 11.25% to 12% |

| PNB PM Cares Education Loan Scheme | To support children who have lost their parents to the COVID pandemic, with financial assistance for education and other needs. | Not specified |

| PNB Honhaar | Education Loan Scheme for pursuing higher education and skill development courses in Delhi. | Not specified |

| Concessional Education Loan | Provided to students or Persons with Disabilities (PwDs) under the bank’s Education Loan schemes. | Not specified |

* Advantages (pros) and Limitations (cons) of the Punjab National Bank Student Loan

| Pros | Cons |

|---|---|

| – Available for students in OCI category | – Not available for students who don’t fall into the OCI category |

| – Available for students born abroad studying in India | – Some documentation charges are applicable |

| – Low interest rates | |

| – Women applicants get 0.50% lower rates |

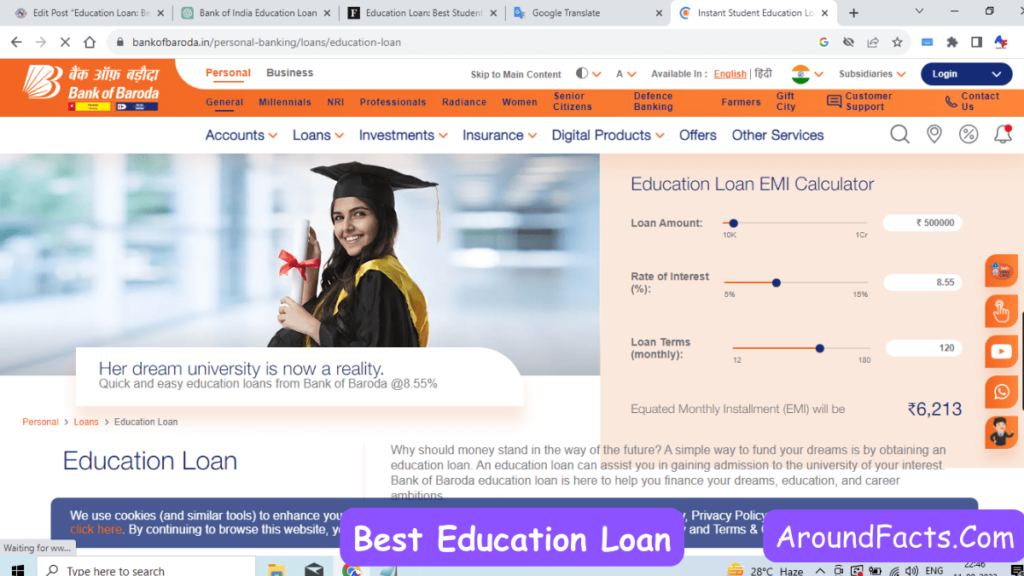

3. Bank of Baroda Check Today Rate – Click Here

Bank of Baroda also offers many types of student loans with their own unique features. Bank of Baroda also provides a good student loan at low interest rates for students who want to study abroad from nursery to 12th. If she is a female student then she can also avail the benefit of 0.50 percent .

Let us know about Bank of Baroda Student Loan in detail …

| Extra Details | Details |

|---|---|

| Processing Fee | Nil. |

| Security | Available. |

| Co-borrowers | Parents or guardians. |

| Margin | 5% for loans above INR 4 lakh. |

| Concession | 0.50% concession in the rate of interest for loans to female students. |

* Bank of Baroda Student Loan

| Loan Scheme | Purpose | Interest Rate (%) Range |

|---|---|---|

| Bank of Baroda – Baroda Vidya | For parents of students pursuing schooling from Nursery to Class XII. | 12.45% |

| Bank of Baroda – Baroda Gyan | For graduate and postgraduate courses. | 11% to 11.10% |

| Bank of Baroda – Baroda Scholar | For graduate and postgraduate studies in reputed universities. | 10.35% to 11.10% |

| Bank of Baroda – Baroda Loan – Premier Institutions | For graduate and postgraduate, degree, diploma studies in premier institutes of India. | 9.10% to 10.15% |

* Advantages (pros) and Limitations (cons) of the Bank of Baroda Student Loan

| Pros | Cons |

|---|---|

| – No processing fee | – Charges upfront fee per property on collateral |

| – Loan available for child’s schooling | |

| – No documentation charges | |

| – Concession available for female borrowers | |

| – Free debit card option |

4. ICICI Bank Check Today Rate – Click Here

Bank of Baroda is far ahead in the matter of providing student loans in India. This bank provides loans to students of 18 to 35 years of age on the basis of their admission in recognized institutions in India or abroad. In this loan, the parents of the student Or parents become co-applicants, this way the student gets a student loan at a lower interest rate.

Let us know in detail about the student loan of Bank of Baroda.

| Extra Details | Details |

|---|---|

| Processing Fee | – Up to 2%. |

| Security | – Fixed deposit, property value, and upon existing loans. |

| Co-borrowers | – Parents or guardians. |

| Margin | – Nil for premier institutes.<br> – Up to INR 20 lakh for others.<br> – Accepted in the form of FD, scholarship, or initial fee paid to the institute. |

| Concession | – I-smart education loans for studies in Canada come with lower rates. |

* ICICI Bank Education Loan Interest Rate

| ICICI Bank Loan Scheme | Purpose | Interest (%) |

|---|---|---|

| Education Loan | For studies in reputed colleges and universities in India and abroad whose admissions are confirmed. | 9.50% onwards |

* Advantages (pros) and Limitations (cons) of the ICICI Bank Student Loan

| Pros | Cons |

|---|---|

| – Loan amount can be increased for extended courses | – High processing fee |

| – Pre-approved loans available | – No concession for women borrowers |

5. Bank of India: Check Today Rate – Click Here

Like Bank of Baroda, in Bank of India too, people are given education loan for their primary education i.e. from class 1st to 12th in the country and abroad. Let us know about this in detail.

| Bank of India Education Loan | |

|---|---|

| Processing Fee | Nil |

| Security | NA |

| Co-borrowers | Parents or guardians |

| Margin | Nil on loans up to INR 4 lakh |

| Concession | Up to 1% concession on RoI |

| for female borrowers | |

| and students pursuing | |

| professional courses |

* Bank of India Education Loan Interest Rate

| Bank of India Education Loan | Purpose | Interest Rate (%) |

|---|---|---|

| Star Education Loan – India | Higher secondary studies in recognized institutions in India | 9.95% to 10.75% |

| Star Education Loan – Abroad | Full-time degree or post-graduation courses abroad | 9.95% to 11.60% |

| Star Vidya Loan | For studies in premier institutions in India | 8.25% |

| Star Progressive Education Loan | Parents of students pursuing schooling from Nursery to Class XII | 9.95% |

* Advantages (pros) and Limitations (cons) of the Bank of India Student Loan

| Pros | Cons |

|---|---|

| Takeover of loans available | Charges one-time fee for any deviation from the scheme norms |

| Option for term Insurance cover | Charges on application online via Vidya Lakshmi web portal |

FAQs

Sbi Pension Loan Interest Rate

Which banks education loan is best?

The best education loan for you can vary based on your personal situation and needs. It’s a good idea to compare options from different banks and lenders to find the one that works best for you. check my article

What student loan is best?

The best student loan for you depends on factors like your financial situation, interest rates, and repayment terms. It’s important to shop around and compare different student loan options to find the one that fits your needs and offers favorable terms.

Keyword

education portal , lakshmi Informational , education maharashtra, punjab education, education,,, loan interest rate, sbi education loan , sbi education loan interest rate, education loan interest ,

, punjab and sind bank customer care number, apply for student loan, indian bank helpline number , hdfc, education loan, punjab national bank helpline number, bank of baroda education loan, canara bank education loan , eligibility , government education loan, sbi student loan, student loan interest rates, education loan for abroad studies, hdfc education loan interest rate, icici education loan, student loan in india, education loan for abroad, education loan in india, canara bank