In a remarkable turn of events, Boeing Co (NYSE:BA) recently made headlines with its earnings call, leaving investors pleasantly surprised. The aerospace giant’s second-quarter earnings report has exceeded Wall Street’s estimates, signaling a potential turnaround for the company. Let’s delve into the details of this unexpected triumph and what it means for Boeing’s future.

Beating Expectations: Boeing’s earnings call delivered some exciting news as the company outperformed projections set by Wall Street. The report revealed a per-share loss of 82 cents on sales of $19.8 billion, a significant improvement compared to the anticipated loss of 88 cents per share on sales of $18.5 billion. This unexpected success brought a sense of relief to investors and ignited early trading activity.

A Turning Point for Boeing Co – Breaking the Earnings Call Curse!

A History of Challenges: Boeing’s journey has not been without hurdles. The company faced difficulties due to the global impact of the Covid-19 pandemic and the prolonged grounding of the MAX jet after two tragic crashes. These challenges led to multiple quarterly earnings misses, but the recent earnings beat showcases a potential turning point for the aerospace giant.

Investor Confidence on the Rise: The positive earnings call has injected a renewed sense of confidence among investors. Boeing’s stock value soared by 4.2% shortly after the earnings report was released, while S&P 500 and Dow Jones Industrial Average futures experienced minor dips. This demonstrates that the market views Boeing’s recent performance favorably.

Navigating Uncertainty: The road to recovery has not been easy for Boeing. With complexities surrounding the 737 MAX grounding and supply chain disruptions caused by the pandemic, analysts have struggled to accurately predict the company’s earnings. However, Boeing’s resilience and continued efforts to move forward from the pandemic have started to show promising results.

Commercial Aerospace Optimism: Investors have taken note of the positive outlook for the commercial aerospace cycle, which has contributed to the rise in Boeing’s stock value. Over the past 12 months, Boeing’s shares have seen a remarkable 35% increase, outperforming the broader market indices, such as the S&P 500 and the Dow Jones Industrial Average.

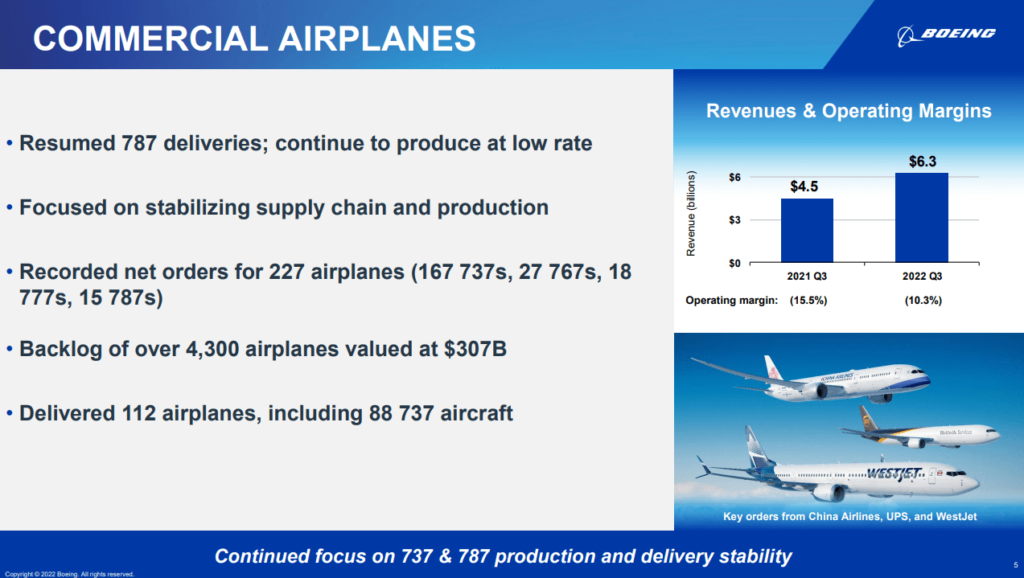

Eyes on Production: Boeing’s increased production has been a significant factor in its recent success. The company delivered 136 commercial jets in the second quarter, surpassing Wall Street’s projections of 103 deliveries. This boost in production may pave the way for further earnings surprises in the future.

Conclusion: Boeing’s recent earnings call has undoubtedly created a buzz in the market. Surpassing Wall Street’s estimates is a step in the right direction for the company’s recovery. While challenges persist, investor confidence is on the rise, and optimism surrounding the commercial aerospace cycle provides hope for a brighter future for Boeing. As the aerospace giant continues to navigate uncertainty, all eyes will be on its production and performance in the coming quarters.